Why Westwood Investors Are Sitting on Gold

If you are looking for a Westside multifamily market that combines stable income, strong appreciation potential, and deep tenant demand, Westwood in zip code 90024 should be at the top of your radar. This neighborhood is not just another Los Angeles submarket. It is a structurally supply-constrained market where investors compete for a handful of properties that trade each year, and that scarcity is exactly what makes it so compelling.

The UCLA Advantage: 40,000+ Students = Unlimited Rental Demand

The single biggest factor driving Westwood's multifamily performance is its relationship with UCLA. With over 44,000 students enrolled, including thousands of graduate students, medical residents, and visiting scholars, the neighborhood has a built-in tenant pool that most Los Angeles areas simply cannot match. These tenants are not looking for short term leases. They need housing for quarters at a time, often for multiple years, and they are willing to pay premium rents for proximity to campus.

What makes this even more attractive is the regular turnover cycle. Unlike markets where tenants stay for five to ten years, UCLA's academic calendar creates predictable vacancy windows where you can reset rents to market rates. For investors, this means your income stream is not static. It has built-in growth triggers every twelve to twenty-four months.

Metro Purple Line: The Game Changer Arriving Now

The Metro Purple Line extension is no longer a future promise. It is here, and it is transforming Westwood's investment calculus. The new Westwood/UCLA station sits squarely in the 90024 zip code, connecting this neighborhood directly to Downtown Los Angeles and the broader Metro network.

This matters for two reasons. First, it expands your tenant pool beyond students to include professionals working in Century City, Beverly Hills, and Downtown LA who now have a viable transit option. Second, it increases rent ceilings across the board. Properties near new transit stations consistently command premiums, and we are already seeing that play out in Westwood's pricing data.

Limited Inventory Creates Bidding War Dynamics

Let us talk numbers because they tell the story clearly. In 2025, Westwood's 90024 zip code recorded only eighteen multifamily sales, three pending transactions, and six active listings. That is an extraordinarily tight inventory for an entire year. Compare that to other Westside neighborhoods where dozens of properties trade monthly, and you begin to understand why Westwood values appreciate faster than neighboring areas.

The pricing data reflects this competition. Six to ten unit buildings, which represent the core investor market, are selling at $425 to $575 per square foot with days on market averaging just twelve to thirty days. Two to four unit properties move even faster, often within five to twenty days, with buyers paying $550 to $650 per square foot. These are not distressed sales. These are competitive market transactions driven by genuine buyer demand.

Persian Square and the Wilshire Corridor Premium

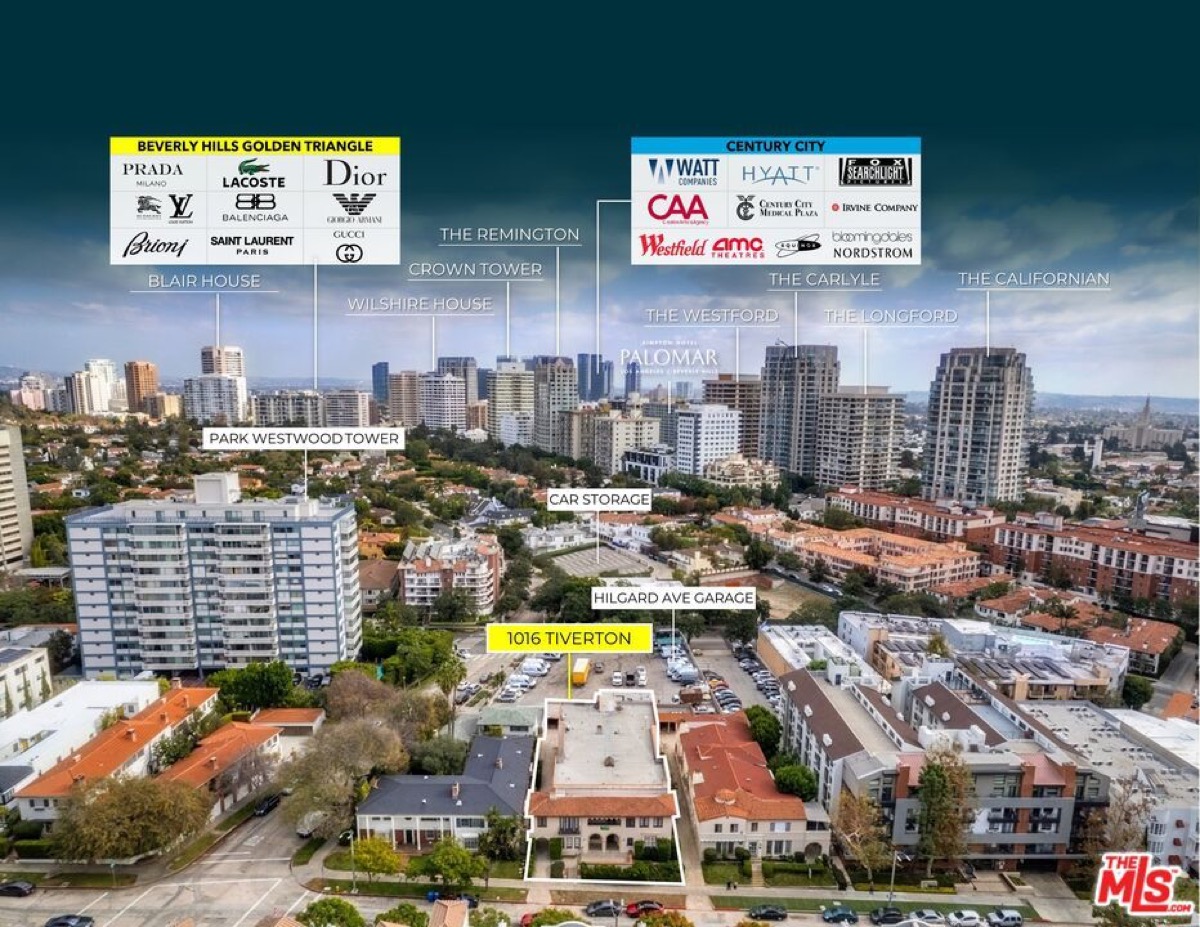

Westwood sits at the crossroads of two high demand corridors. Persian Square, often called the "Little Persia" district along Westwood Boulevard, provides the neighborhood with a commercial anchor that draws residents from across Los Angeles. Meanwhile, the Wilshire Corridor connects directly to Century City, one of the largest job centers on the Westside.

Investors should note that properties along or near these corridors command a premium. The walkability factor cannot be overstated. Tenants in Westwood Village and surrounding blocks have access to restaurants, grocery stores, pharmacies, and services all within walking distance. This convenience premium translates directly into higher occupancy rates and faster lease-up times for renovated units.

Why New Construction Remains Rare

Despite strong demand, new multifamily construction in Westwood remains limited. The reasons are structural. Land costs are extremely high, zoning complexity creates delays, and the existing rent control environment makes new development economics challenging. This is actually good news for existing property owners. When supply cannot keep pace with demand, your existing inventory becomes more valuable, not less.

For investors considering value-add strategies, this scarcity creates an attractive dynamic. You can renovate units, increase rents, and improve property values knowing that new competition is not coming online to undercut your pricing. The supply-demand equation in Westwood favors existing owners for the foreseeable future.

Investment Thesis Summary

Westwood is not a market for speculative investors looking for quick flips. It is a hold-and-collect market where patient capital earns reliable returns while appreciation compounds over time. The key metrics support this thesis. Average prices hover around $400,000 per unit with cap rates near 4.8 percent. Vacancy rates stay low at approximately 3.2 percent, and one-bedroom rents average $2,450 per month.

If you want exposure to the Westside's strongest fundamentals, UCLA's guaranteed tenant base, and the transit-driven appreciation coming from the Purple Line, Westwood 90024 should be your primary target. Just be prepared to move quickly when inventory becomes available, because properties in this submarket do not last long.